A team of professionals

committed to enhancing

corporate value

In accordance with

“Corporate Value = Cash Flow / Cost of Capital”

We provide advice not only on cash flow,

but also on analyzing and improving

the denominator, the cost of capital.

SOLUTION

We offer a wide variety of solutions

to meet your challenges.

Solution Overview

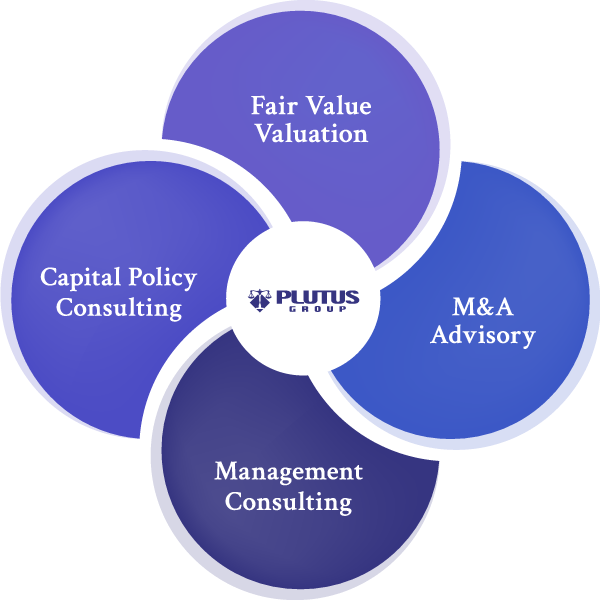

A comprehensive consulting firm that supports corporate growth from multiple perspectives, including fair value assessment, M&A support, and management and capital strategies.

PLUTUS GROUP is a comprehensive consulting firm that provides management consulting services in addition to fair value assesment, securities design, and one-sided M&A advisory services.

The entire group handles strategic capital policy formulation, M&A and business succession, incentive plan design, and PBR improvement through cost of capital analysis. In addition,

we provide multifaceted support for corporate growth through strategic planning and performance improvement consulting in response to management issues.

In this way, we maximize the value of client companies.

Solution Introduction

-

Valuation of Equity

As the largest stock valuation company in Japan, we ensure accountability to our clients.

-

Stock Options

We are developing a variety of new stock options, including paid options.

-

Accounting advisory services

We resolve complex accounting issues such as IFRS transition, PPA, impairment testing, etc.

-

M&A and Reorganization

We provide one-stop services for various M&A operations and advice on capital policies.

-

Services for venture companies

We support capital policies using stock options and class shares, as well as EXITs other than IPOs.

-

Sell-side advisory

We aim to maximize the seller's profit by fully understanding your company in order to conclude M&A transactions on the terms desired by the seller.

-

Buy-side Advisory

We support strategic M&A to accelerate growth strategies, market development, or the realization of mid- to long-term strategies.

-

Mid-term business plan

Provide hands-on support/ PMO support for business planning

-

FP&A

We formulate business strategies and reorganization and M&A strategies through expert numerical analysis, data management, etc.

-

Business Due Diligence to PMI

We provide one-stop support from business due diligence to PMI

-

Organizational Development/Human Capital Management

We provide business process transformation, organizational transformation based on human capital management strategies, and ISO 30414 compliance

GROUP ORGANIZATION

-

Consulting firm for corporate valuation

PLUTUS CONSULTING Co., Ltd

Please feel free to contact us if you are considering stock price valuation, stock option issuance, stock acquisition rights issuance, TOB, MBO, third-party committee establishment, due diligence, share exchange/share transfer, IPO, debt equity swap, IFRS transition, financial statement preparation, etc.

-

Specializing in M&A advisory services

PLUTUS Management Advisory Co., Ltd.

We provide free consultation regarding M&A and business succession. We do not engage in any intermediary activities, but rather act as the client's exclusive advisor (FA), thoroughly pursuing the maximization of the client's profit. Please feel free to contact us.

-

Management Counselor to Improve Corporate Value

ProFinX Co.

We contribute to the enhancement of corporate value of Japanese companies by strengthening their CFO and corporate planning functions through “providing highly specialized management personnel teams” and “supporting the introduction of data management.” Please feel free to contact us.

RANKING

PLUTUS GROUP ranked 2nd in the 2024 Full-Year “Japan Mid-Market M&A Financial Review” published by LSEG.

- “Japan Mid-Market M&A Financial Advisory Review”(Full Year 2024)published by LSEG

PLUTUS GROUP ranked 2nd in the 2024 Full-Year “Japan Mid-Market M&A Financial Review” published by LSEG (formerly Refinitiative) in terms of Rank Value (USD 0.5 billion or less) related to Japanese companies.

| RANK | Financial Adviser | Value US$mil | # of Deals |

|---|---|---|---|

| 1 | Mizuho Financial Group | 812 | 108 |

| 2 | Plutus Group | 673 | 63 |

| 3 | Nomura | 527 | 49 |

| 4 | KPMG | 511 | 101 |

| 5 | Deloitte | 399 | 98 |

| 6 | Yamada Consulting Group Co Ltd | 379 | 47 |

| 7 | Sumitomo Mitsui Finl Grp Inc | 367 | 77 |

| 8 | Daiwa Securities Group Inc | 336 | 35 |

| 9 | AGS Group | 236 | 29 |

| 10 | M&A Capital Partners Co Ltd | 196 | 170 |